Many people think that owning an older car means that they would pay less for coverage. However, this is rarely ever the case. Insuring an older car is just like insuring every other car; the type of coverage that you receive should be a combination of your needs and priorities, your budget, and the laws and regulations where you live. Car insurance is designed to protect you in case of an accident, which is always the case regardless of the type of car you own. While it would be nice to pay less money, especially since your car is not brand new, protecting yourself and your car may be worth the expense. Here are the top things that you need to know about insuring older cars.

Classic Cars

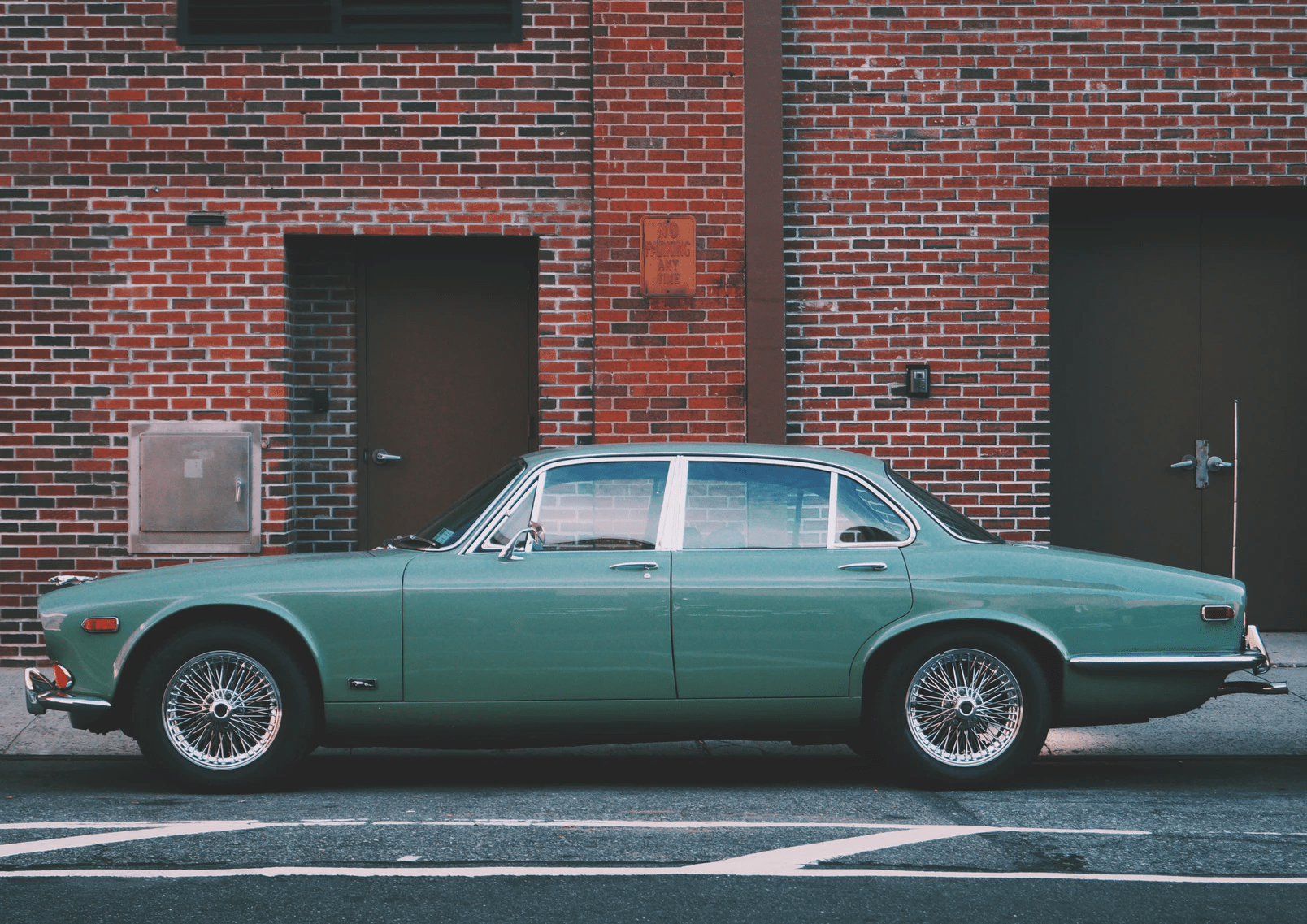

Is your car a classic, or is it just old? This is the first thing that you should think about when you are looking to insure your old car. Keep in mind that the qualifications for a classic car are really high; your red vintage coupe may not be a classic after all. Finding out if your car is a classic one is important as classic cars have a designated type of insurance. While you can insure your car with traditional car insurance, its full value may not be covered. This is because traditional insurance takes factors such as mileage, age, and depreciation into consideration when determining its worth. However, classic car insurance uses the actual cash value to determine the worth.

Don’t automatically think that owning a classic car means that you’ll be paying a higher premium. Statistics suggest that the cost of insuring a classic car is around 36% less than insuring a regular car. This is because policies and types of coverage are generally customized to your particular needs. You should make sure that you have the best inclusion and coverage that you can manage within your budget. Consult a classic car insurance expert because when you are insuring a classic car, in particular, you have very limited options when it comes to replacement parts. They are hard and expensive to find, which is why finding the best policy is crucial.

Premiums

Among the top things that almost everyone considers when they look into the expenses of insuring an old car is the monthly payment that is being made to the insurance agency. It’s important to look into the best options and do your research. You should click here to gain more insight, and understand that there is very low to no connection between the age of the car and the insurance rates. Although age is accounted for, it doesn’t mean that you’ll be paying a lower premium. However, like any other policy, you can choose to pay less by lowering the amount of coverage that you’ll receive. You should also find out if your car lacks specs that protect it from the possibility of theft, then you may end up paying higher premiums.

Maintenance and Repair

If you’ve owned a vehicle for long enough, then it is likely that you’ll eventually have to get it repaired at some point. Having an old car increases the chances and the need for repair and maintenance. If your old car needs maintenance, it will be extremely harder for you to find replacement parts than it would’ve been if you owned a newer model. Besides, the ones you find are likely to be more costly. Factoring in the costs of repairs when you are creating a comprehensive budget for your car is quite important. The costs of sourcing suitable repair parts for your vehicle are possibly considered in your insurance payment.

Comprehensive and Collision Coverage

Learning the differences between comprehensive, or physical damage, and collision coverage are very important. If you want to significantly and easily reduce your monthly premiums, you can cut the comprehensive coverage. This type of coverage only covers damages that occur as a result of a collision or an accident. The older your car is, the less money you’ll receive if you get into a car accident anyway. If you’re a relatively safe driver and can manage to save for the replacement of your car, then you should get rid of this type of coverage. However, if you tend to drive recklessly and can’t afford to purchase a new car any time soon, then dropping comprehensive coverage may not be a good idea after all. Dropping this type of coverage is not an option either if you’re still not done funding your car loan. It’s also important to understand your state’s take on these types of coverage before making a decision as they are required in some areas.

Car insurance is generally very confusing as there are many things to keep in mind and consider when you are searching for the best policy and insurer. With old cars, this task gets even more perplexing. The parts are harder to find and replace, and the circumstances revolving around your vehicle are much more restricting. This is why we collected the things you should know about insuring old cars.